When examining condo sales in 2023, one-bedroom units dominated the market, signaling a strong preference for efficient, streamlined living. However, a deeper look into the data reveals a surprising shift in buyer behavior beyond expected trends. As post COVID real estate trends and preferences evolve, it becomes clear that buyers are prioritizing certain floor plans in ways the industry did not fully anticipate. What exactly drove this change, and how did buyers respond to the pressures of rising costs, shifting lifestyles, and evolving real estate trends? Let’s dive into the data to uncover the unexpected shifts in Manhattan’s condo market.

Key Takeaways:

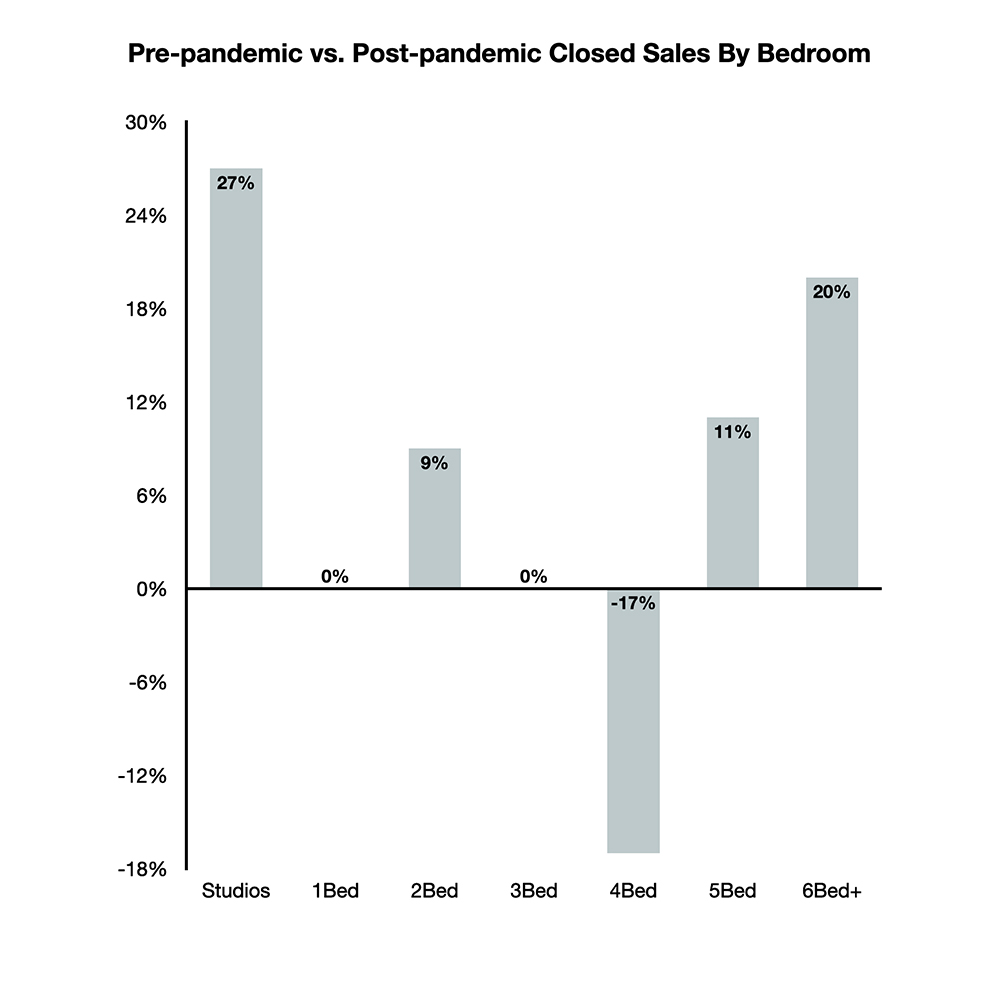

- Unexpected Preference for Studio Apartments: Unlike expectations, studio apartments saw the largest percentage growth in post-pandemic sales, driven by rising costs and evolving buyer preferences.

- Larger Units for Growing Families: While studios thrived, larger units like 5- and 6-bedroom floor plans also experienced notable growth as families upgraded to accommodate more living space, leaving the 4-bedroom units behind.

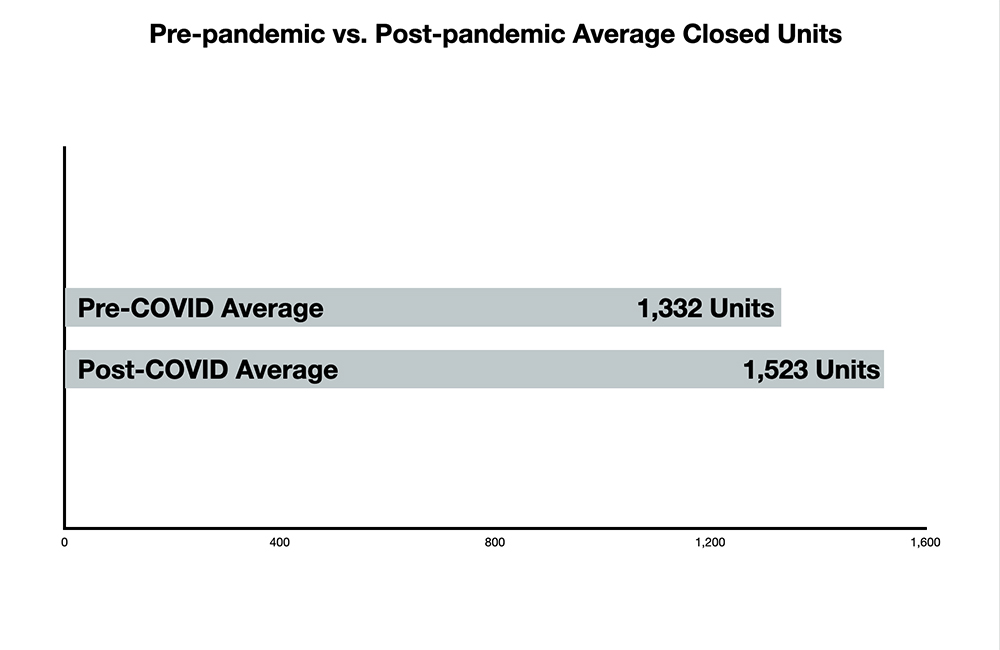

- Increased Demand for Outdoor Space: Condo units with outdoor space saw a 14.3% increase in closed sales, highlighting the growing importance of private or shared outdoor areas for buyers seeking a connection to nature and personal outdoor spaces.

- Outdoor Units Recover Faster: Although units with outdoor space suffered sharper price declines during market downturns, they rebounded faster than the overall market, maintaining a premium per square foot compared to units without outdoor space.

Receive the Private Edition

The shift toward studio apartments

Many in the real estate industry expected buyer preferences to shift towards larger apartments due to work-from-home policies, the growing need for multifunctional living spaces, and a lifestyle change that included going out less. It seemed logical that more space would be a priority.

However, when analyzing actual closings, studio apartments saw the largest percentage increase in sales compared to pre-pandemic patterns. Specifically, sales of studio units grew by 27% post-pandemic, a significant jump that contrasts with the minimal change in demand for other units.

Several factors contributed to this trend, aligning with broader post COVID real estate trends. First, rising prices pushed many buyers toward smaller units. Post-pandemic, there was a surge in prices due to low inventory, as demand that had been held back during the pandemic quickly absorbed excess supply.

Higher borrowing costs further constrained budgets, making studio apartments more appealing. Another driving factor is the increase in condominium amenities. Buyers now rely more on shared spaces like work-from-home areas, lounges, rooftops, and other common areas than their living space.

This shift allows residents to entertain guests or work outside their apartments, reducing the need for larger personal units. These changes in buyer behavior reflect broader real estate trends after COVID-19, as smaller, amenity-rich living options become more attractive.

While studio apartments experienced the largest growth post-pandemic, larger units have also seen notable increases in demand. Sales of 5-bedroom units grew by 10%, while 6-bedroom units saw a 20% rise in closings.

In contrast, the 4-bedroom floor plan experienced a decline of nearly 9%. This shift is mainly due to larger families upgrading from the 4-bedroom layout to even bigger units. More living space is necessary for these families, as they require additional bedrooms, play areas, and personal space that building amenities cannot fully replace.

Unlike single individuals or smaller households who might take advantage of shared amenity spaces, larger families prioritize more private living space, making the larger units more attractive post-pandemic.

Increase demand for outdoor space

Sales of condo units with outdoor space increased by approximately 14.3% post-pandemic compared to pre-pandemic levels. The average number of closed sales for these units rose from 1,332 pre-pandemic to 1,523 post-pandemic.

This shift reflects the growing demand for outdoor living areas, as buyers increasingly prioritize access to private or shared outdoor spaces in response to lifestyle changes brought on by the pandemic. As post COVID real estate trends evolve, condos with terraces, balconies, or rooftop access have become highly desirable, appealing to those who value fresh air and personal outdoor space.

With more people spending time at home, outdoor living spaces have become essential to many homebuyers. This trend is expected to continue as outdoor space remains a crucial part of post COVID real estate trends.

Price comparison between outdoor space and the market at large

In Manhattan, luxury units that trade at higher prices often experience sharper price drops during market downturns but tend to recover faster. The same trend is evident when comparing units with outdoor space to the overall market.

From August 2023 to January 2024, units with outdoor space saw a 16.13% decline in price per square foot, dropping from $1,754 to $1,471. In comparison, the overall market experienced a 13.16% decline, from $1,634 in August 2023 to $1,419 by February 2024. However, by March 2024, units with outdoor space had rebounded significantly, trading well above their January levels at $1,629 per square foot, while the overall market showed a more modest recovery, reaching $1,531.

This demonstrates that while units with outdoor space are more vulnerable to sharper declines, they tend to recover faster and maintain a premium over the broader market.

Conclusion

In conclusion, the post COVID real estate trends reveal some surprising shifts in buyer preferences. While one-bedroom units dominated 2023, studio apartments and larger family units have gained significant traction, driven by affordability, lifestyle changes, and the growing appeal of shared amenities.

Additionally, the demand for outdoor spaces continues to rise, with units offering terraces and balconies commanding a premium. Despite sharper downturns, these units have shown a quicker recovery, maintaining their value in an evolving market. As the real estate market adapts, these trends offer valuable insights into what buyers prioritize in a post-COVID world.