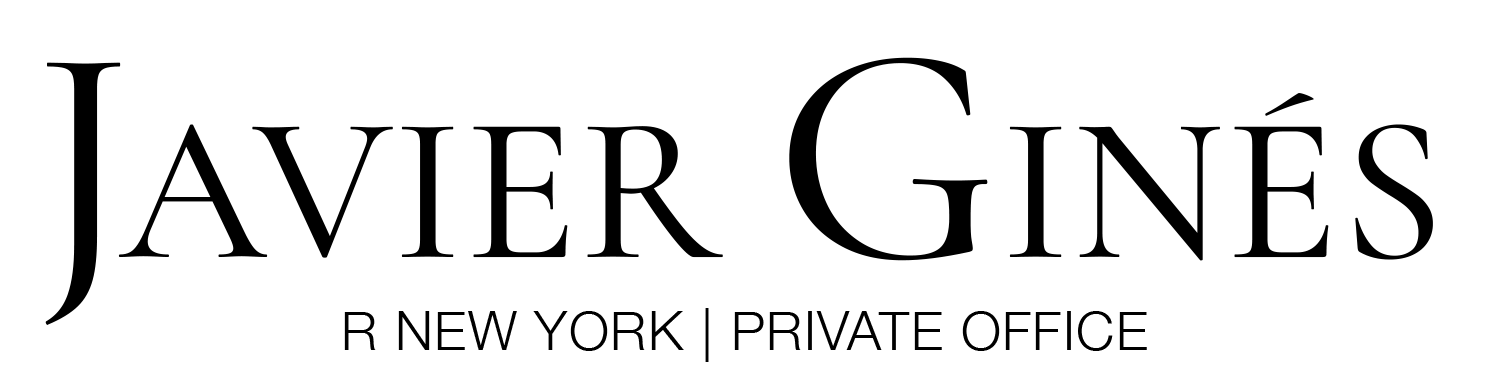

The New York City condominium market has been incredibly active in 2024, with weekly signed contracts regularly outpacing averages from what I consider “normal years” before the pandemic. This level of demand paints a picture of a robust market, but not every segment shares equally in the success. New developments NYC, for all their appeal, aren’t benefiting proportionally from this increased activity.

Key Takeaways:

- 2024 is a standout year for the NYC condominium market: Weekly signed contracts are significantly higher than the average for normal years, showcasing strong buyer activity.

- Pricing constraints limit developers’ flexibility: Lenders and stakeholders prevent significant price reductions, pushing developers to offer concessions such as covering closing costs or providing upgrades.

- Greater pricing flexibility benefits the secondary market. Sellers of resale properties can more freely adjust their prices, making these units more competitive in a high-demand market.

Receive the Private Edition

The Year of Condominium Residences

2024 is proving to be an exceptional year for condominium residences in New York City. Weekly signed contracts have consistently surpassed the average in “normal years” like 2018, 2019, and 2023. This increase in activity illustrates a strong market driven by heightened buyer interest and a return to stability following years of pandemic-related fluctuations.

The demand is not confined to a particular market segment—buyers actively sign contracts across various price ranges, building types, and neighborhoods. What distinguishes this year is the activity level and confidence it conveys in the market. Despite rising interest rates and global economic uncertainties, the desire for condominium residences continues to be strong.

Challenges Facing New Developments NYC

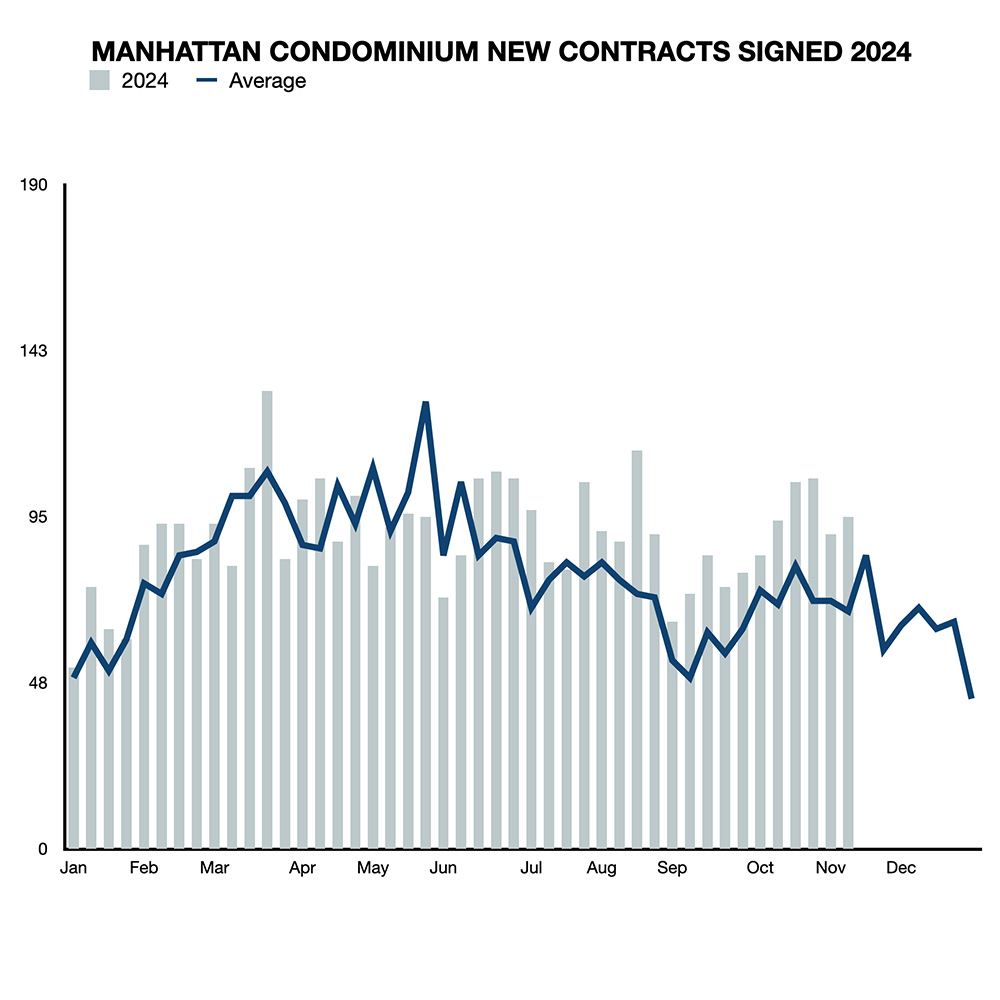

Despite the strong demand for condominiums in 2024, new developments NYC are not capturing a proportional market share. This is highlighted by the declining market share of new projects relative to the overall condominium market, even as total sales activity remains strong.

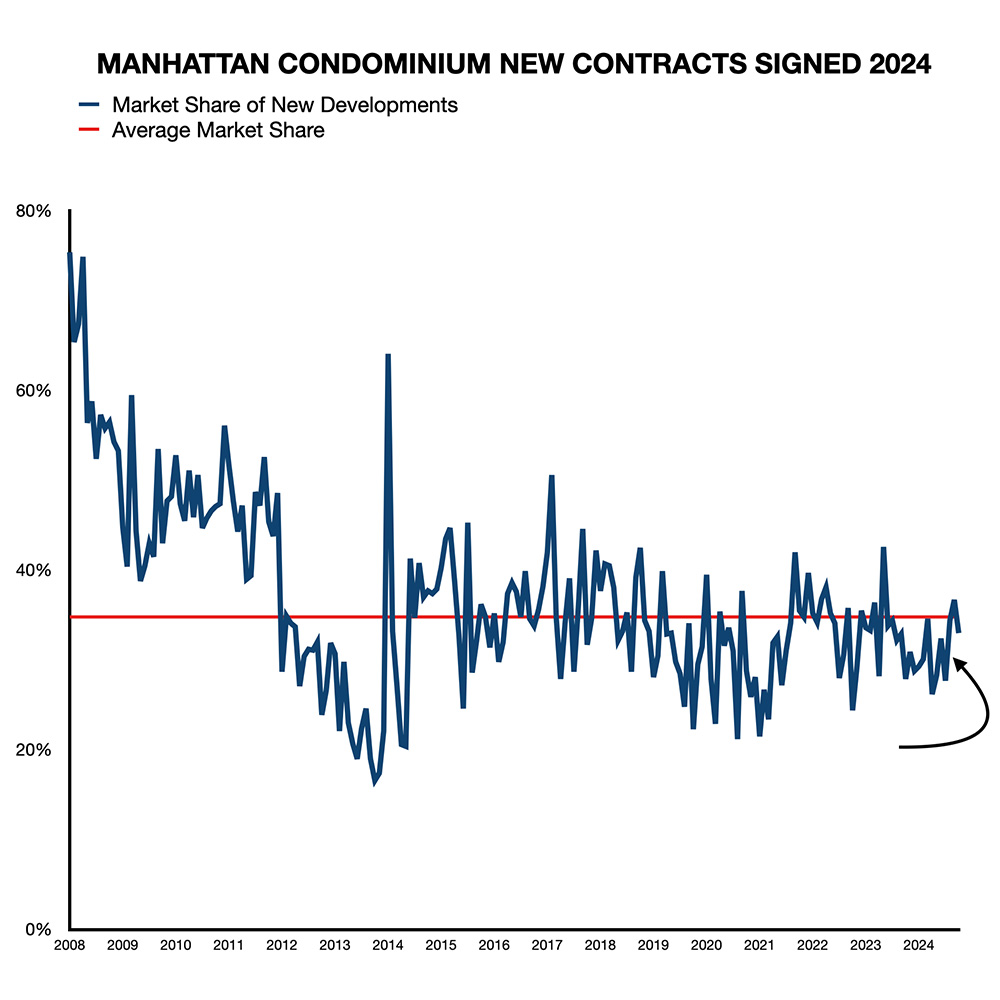

Compounding this issue is the shrinking pipeline of new development listings, which limits buyers’ opportunities to consider new construction. As fewer projects come to market, the ability of new developments to maintain their presence in the market has diminished.

A primary challenge is the financial constraints developers encounter. Unlike sellers in the secondary market, developers of new projects face strict limitations set by lenders and equity partners. These financial backers expect projects to meet certain profit margins, making it difficult to implement significant price cuts. As a result, developers typically offer concessions—like covering closing costs or providing upgrades—to attract buyers without directly adjusting prices.

However, the media sometimes reports on significant price reductions for new developments. These figures often originate from estimates presented in offering plans, calculated years prior to sales. For instance, Gary Barnett began assembling the lots for Central Park Tower as early as 2005. The offering plan was submitted in July 2016, and sales started in October 2018. These estimates attempt to reflect market conditions during the planning and financing stages, but they often overlook shifts in demand or economic factors that may arise years later. Consequently, while it may appear that developers are significantly lowering prices, these changes typically mirror outdated projections rather than true flexibility.

The economics of large-scale developments emphasize this issue. Projects like 432 Park Avenue, costing $1.25 billion, or the projected $3 billion for Central Park Tower, require immense upfront investments. Developers finance these projects through debt and equity, with commitments to repay lenders and deliver returns to equity investors. This financial structure leaves little margin for developers to make considerable pricing adjustments without jeopardizing the profitability of their projects.

Timing is also crucial. Developers heavily rely on market conditions aligning with their pricing strategies when projects are complete. Although 2024 has been a strong year for the condominium market, the slower absorption rates of new developments indicate buyers may prefer the pricing flexibility and promptness of resale properties. Additionally, as appraiser Jonathan Miller has noted, the “pipeline is empty.” Fewer large-scale projects have been initiated due to rising construction costs, land scarcity, and post-COVID economic realities. Without a robust pipeline of new inventory, developers face increasing difficulty staying competitive while managing long timelines and financial limitations that restrict their ability to adjust to changing market trends.

Advantages of the Secondary Market

In 2024, the secondary market established a competitive advantage mainly due to the flexibility that individual sellers can offer compared to developers of new projects. Developers may attract buyers through concessions like covering closing costs, offering upgrades, or providing incentives for early closings, yet individual sellers can only sometimes offer such benefits. Nevertheless, this limitation can be advantageous in other ways.

A significant benefit of the secondary market is its pricing flexibility. Individual sellers are not tied to developers’ financial constraints, such as obligations to lenders or equity investors. This lack of constraints enables them to adjust prices more freely, making resale properties increasingly attractive to price-sensitive buyers. Moreover, individual sellers often can negotiate more flexible closing dates, catering to a buyer’s schedule instead of adhering to the rigid timelines common in new developments.

This flexibility in pricing and terms has proven particularly appealing in 2024, as the condominium market remains active and competitive. Buyers wanting immediate occupancy or looking for value in a high-demand market frequently prefer resale properties, where negotiating options are abundant.

As a result, the market dynamic favors resale properties, which offer clear pricing and schedules tailored to buyer preferences. This adaptability highlights the critical role of the secondary market in providing balance and options within New York City’s bustling condominium landscape.

Implications for Buyers and Developers

The 2024 condominium market presents distinct challenges and opportunities for buyers and developers, influenced by the different tactics of new developments NYC and the secondary market.

For Buyers

In 2024, buyers will encounter a unique array of opportunities. In the secondary market, they benefit from increased pricing flexibility and negotiable terms, like closing dates. This flexibility particularly appeals to those wanting immediate occupancy or better value in a competitive landscape. However, resale properties generally lack the benefits developers offer, such as covered closing costs or custom upgrades, which can mitigate the higher initial prices of new developments NYC.

With new construction, buyers enjoy access to contemporary designs, cutting-edge amenities, and sometimes the prestige of owning a unit in landmark buildings like Central Park Tower or 432 Park Avenue. Although the prices for these units may appear rigid, developers often provide concessions that can significantly ease financial burdens or enhance the overall value of the purchase. Understanding how these incentives compare to the pricing flexibility in the secondary market is crucial for buyers assessing their choices.

For Developers

For developers, the situation is more intricate. The strong market of 2024 brings mixed outcomes: while demand remains robust, the relatively sluggish performance of new developments NYC underscores the limitations of their pricing and sales strategies. Developers must strike a careful balance between sustaining profit margins and staying competitive in a market where buyers are increasingly attracted to the flexibility of resale options.

Implementing strategies like offering targeted concessions—such as covering a portion of closing costs or providing tailored upgrades—enables developers to distinguish their offerings without jeopardizing long-term pricing expectations. However, the lengthy timelines for planning and construction necessitate developers to consider evolving buyer preferences and broader economic shifts that may unfold during a project’s lifecycle.

Conclusion

The 2024 NYC condominium market is thriving, but new developments face unique challenges in capturing a proportional share of the activity. A shrinking pipeline of new projects, rising construction costs, and land scarcity have constrained the supply of new listings, limiting buyers’ opportunities to engage with new developments. At the same time, developers must navigate pricing constraints and rely on concessions to attract buyers, all while competing with the flexibility and immediacy of the secondary market.

For buyers, choosing between new developments and resale properties often comes down to priorities: modern amenities and developer incentives versus pricing flexibility and negotiable terms. For developers, the shrinking pipeline raises questions about how to sustain momentum in the years to come, mainly as fewer projects are initiated.

As the market evolves, the delicate balance between supply and demand will shape NYC’s condominium sector trajectory. Developers and buyers must adapt to a landscape marked by reduced inventory, rising costs, and shifting buyer preferences. The decisions made today will impact the vibrancy and accessibility of New York City’s real estate market.