The real estate industry has undergone significant changes in recent years, particularly with the rise of team-based business models.

Nowadays, when a team leader agent brings other agents as team members, they pool individual sales together and use that collective sales record as the primary tool for acquiring clients instead of providing market insights from custom research as other types of brokerages do.

As a result, individual agents tend to focus less on sales data for market insights and more on anecdotal information resulting from their transactions.

For those working at large corporate firms, market reports are often provided by their research department, but they can be quite basic and fail to capture the specific nuances of a particular market.

Other agents may simply repeat general talking points they’ve heard from financial experts without properly applying them to their local market.

All of this is problematic because the real estate market is highly localized and requires a nuanced understanding to advise clients properly. To illustrate this point, let me provide you with two examples.

1. Low Inventory

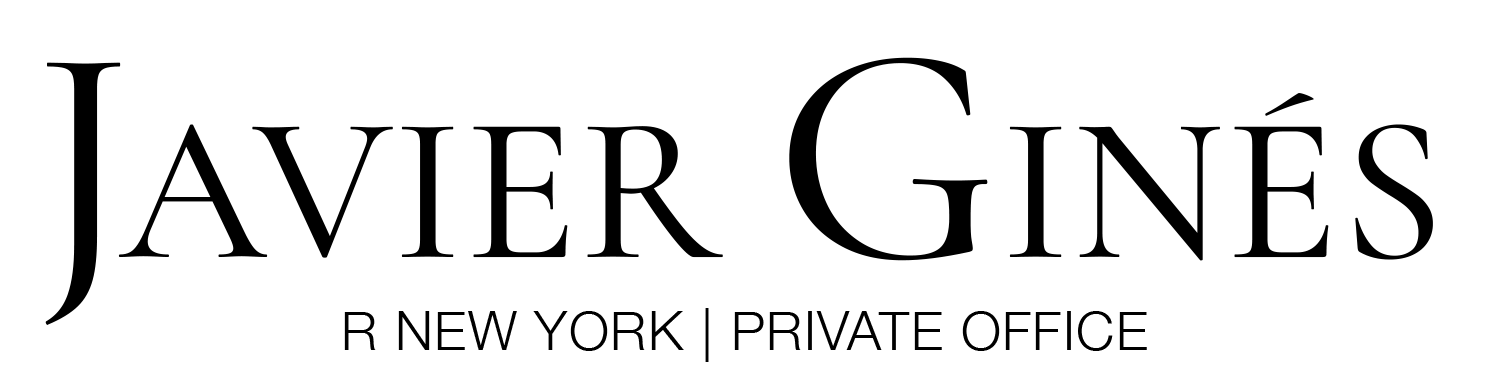

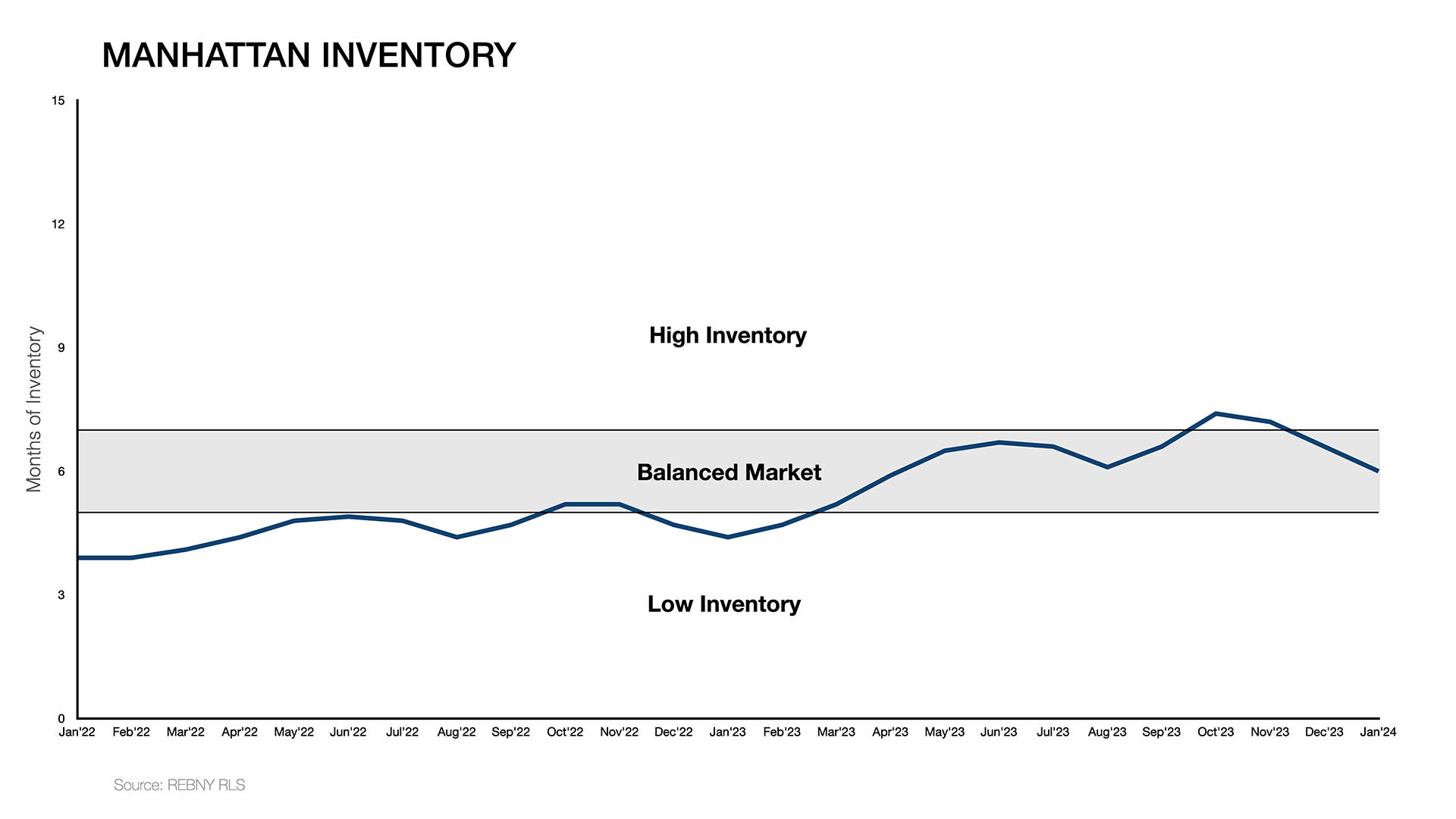

Last year, real estate agents and executives from brokerage firms reported a shortage of inventory for sale. While this may be true for markets across the country, this is not the case for the overall market in Manhattan or for condominiums specifically.

The market did suffer from low inventory in 2022. Manhattan started 2023 having 4.4 months’ worth of general inventory and 5.3 months’ worth of condominium inventory. By October, the general market reached its peak with 7.4 months of general inventory and 8.1 months’ worth of condominium inventory.

In real estate, a balanced market holds 5 to 6 months of inventory. Anything below 5 months is considered low inventory, indicating a seller’s market and anything above 7 months is considered high inventory, indicating a buyer’s market.

As of the end of January 2024, Manhattan has 6 months’ worth of inventory for the overall market and 6.9 months’ worth of condominium inventory. Therefore, while there may be a shortage of homes for sale in the country at large or in many markets across the country, that is not the case in Manhattan. 2023 was a year of inventory expansion, and yet some real estate professionals keep insisting that inventory is low.

2. Weak Sales Activity

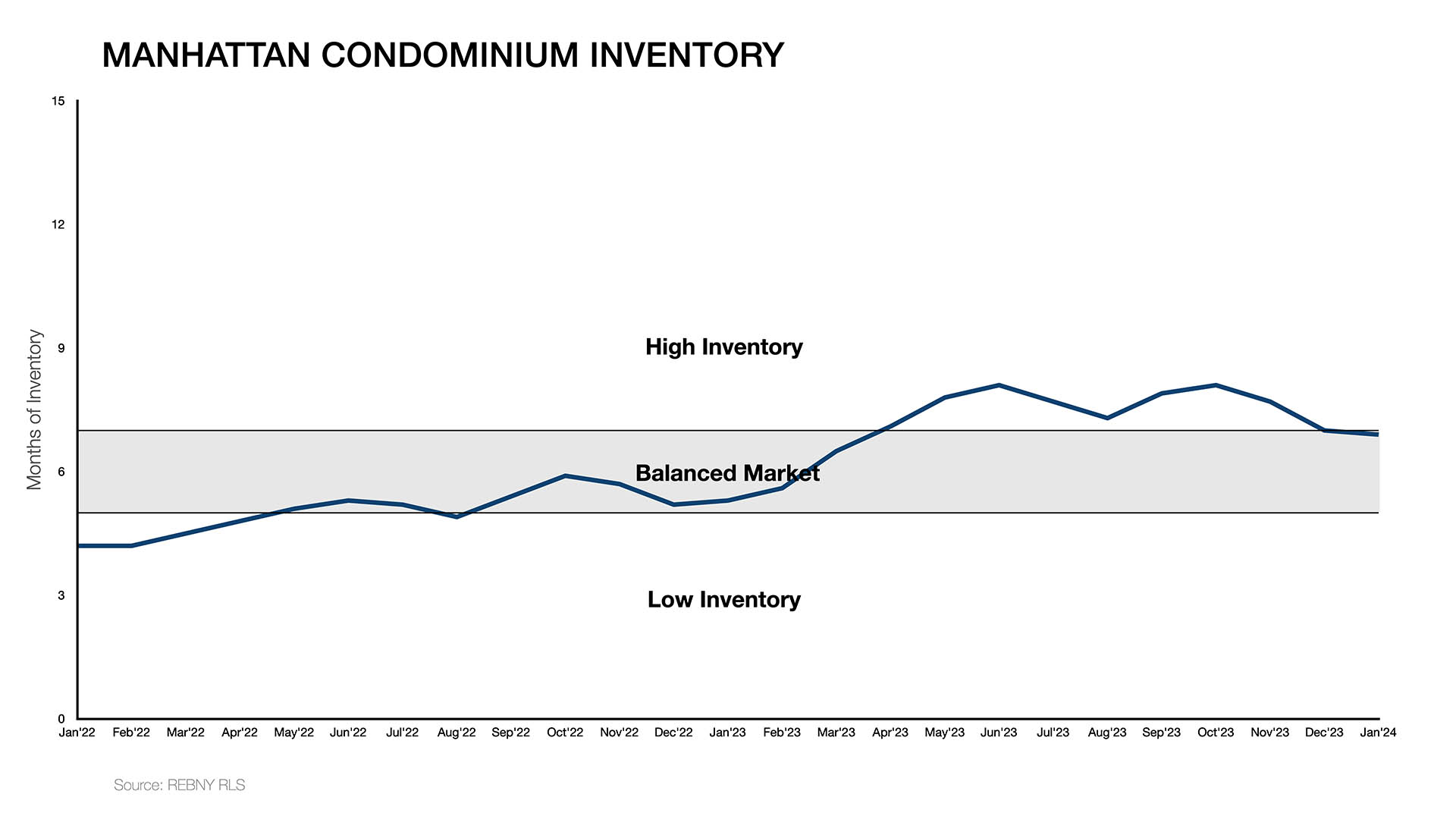

The second example is related to the amount of sales. According to some real estate professionals, there has been a decline in sales activity. However, the numbers tell a different story.

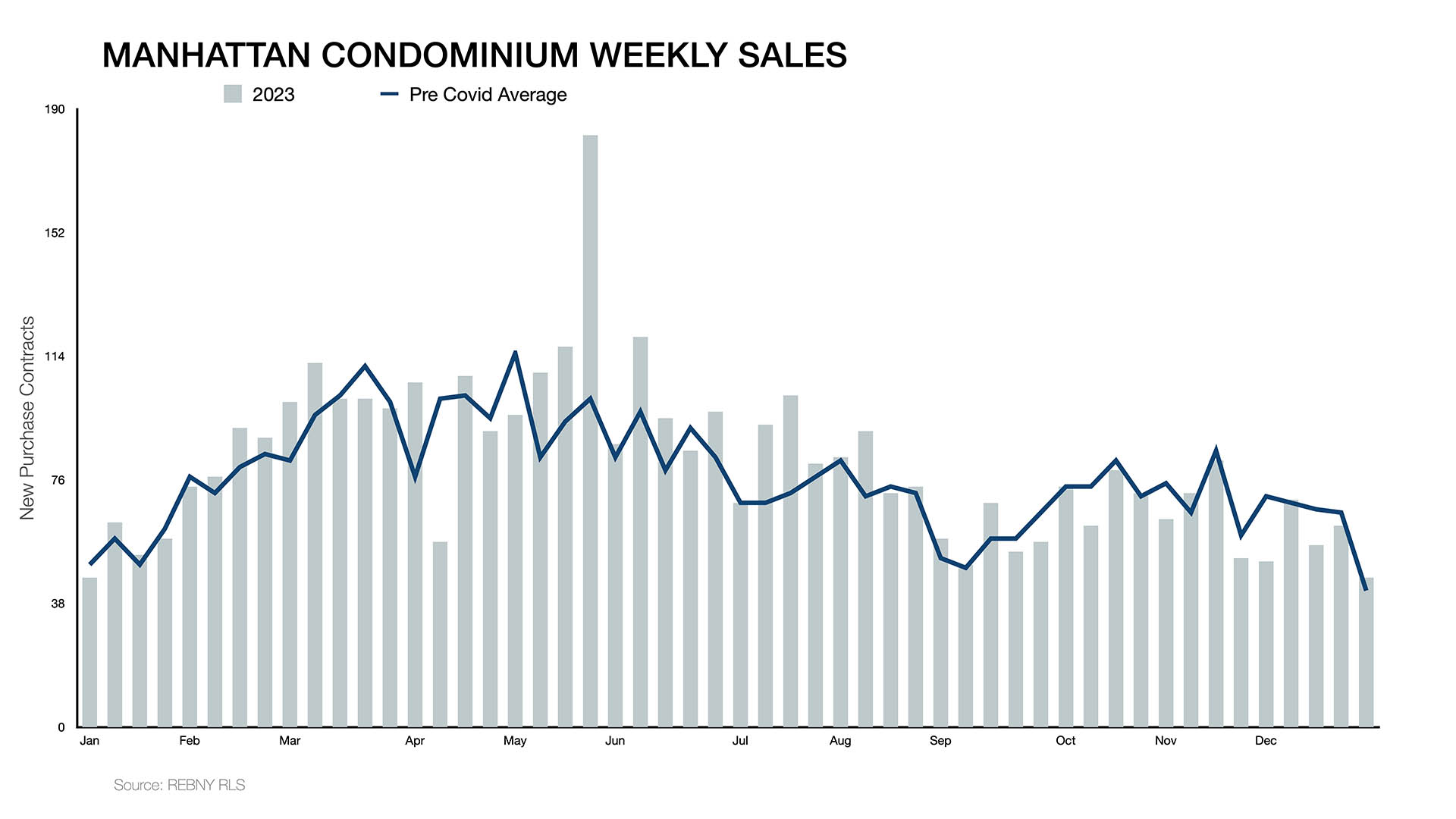

In the year 2023, on average, 191 sale contracts were written per week, which is the same as the pre-covid historical average.

Interestingly, the condominium market performed better by writing 82 contracts per week, surpassing the pre-covid historical average of 77 contracts per week.

According to the sales data, the condo market exceeded historical averages while the general market returned to its normal level of activity.

When I began my career in real estate brokerage over 20 years ago, my top priority was always to serve my clients’ best interests.

The real estate market in New York City is very complex, which makes it challenging to navigate. Rather than focusing on completing transactions for various asset classes across multiple boroughs simply to boost my sales record, I prefer to concentrate on a specific asset class and provide the highest degree of specialized services to my clients.

That is why I created this digital desk. Here, you will find my research and insights on Manhattan’s condominium market, along with stories about their design and production. I also provide resources to help you make informed decisions on buying, selling, or renting a condominium residence in Manhattan.

Receive this content straight to your inbox.