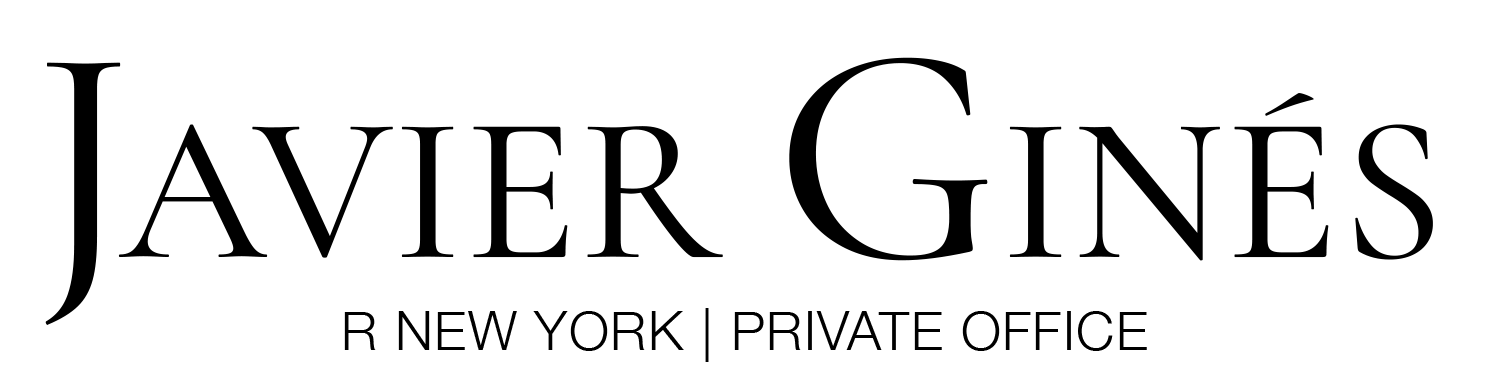

Manhattan condo prices sharply declined from the end of 2023 until the first quarter of 2024 due to rising inventory and a shift in market conditions. While prices have started to recover, they remain below 2018 levels.

A combination of post-pandemic factors, including a surge in available listings, drives this change. In this article, we’ll explore the reasons behind the price drop, the role of inventory in the Manhattan condo market, and what this means for buyers and sellers in the coming months.

Key Takeaways:

- Price Decline: Manhattan condo prices declined sharply in early 2024, driven by rising inventory.

- Recovery: Prices have started to recover but remain below their 2018 peak due to sustained inventory levels and economic factors.

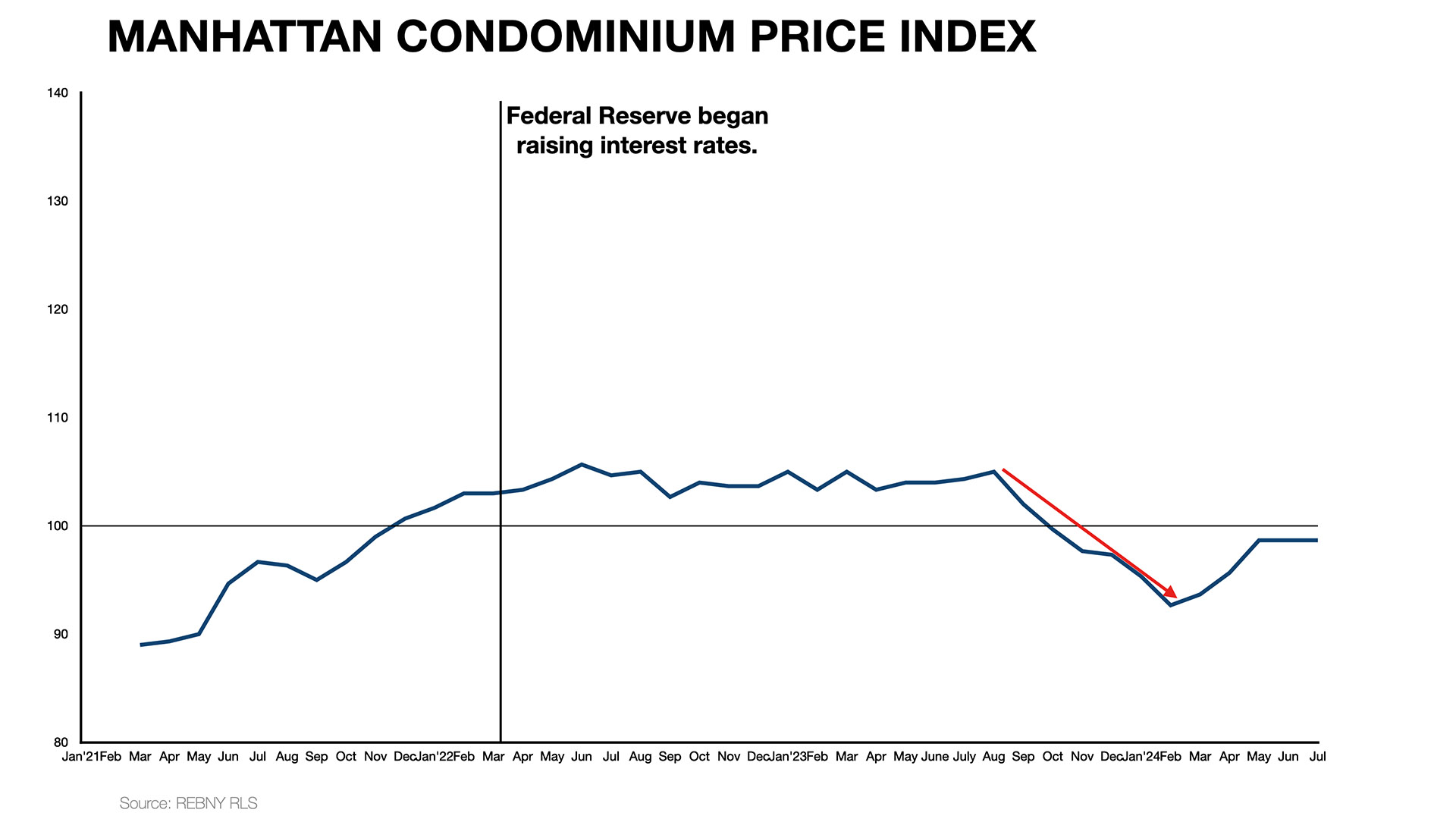

- Inventory Surge: High inventory levels at the start of 2024, exceeding 7 months, contributed to a buyer’s market, giving buyers more negotiating power.

- Buyer’s Market: The market remains favorable for buyers, with more options and lower prices, while sellers must adjust their pricing to stay competitive.

- Market Outlook: Buyers should take advantage of current conditions, while sellers must prepare for slower sales and price negotiations as the market adjusts.

Receive the Private Edition

Understanding the Price Decline

Manhattan condo prices significantly declined in early 2024, marking a notable shift in the NYC real estate market. This decline was primarily driven by a surge in inventory in 2023, which altered the balance between supply and demand.

In the first quarter of 2024, inventory levels soared beyond 7 months—far above the 5 to 6 months typically seen in a balanced market. This shift resulted in more available units than active buyers, pushing Manhattan condo prices down. Now competing with an oversupply, sellers were forced to reduce their asking prices to attract buyers.

Several factors contributed to this oversupply:

Post-pandemic market dynamics: As the real estate market reopened after the pandemic, sellers who had held off during 2020 and 2021 flooded the market with new listings in 2022 and 2023.

Pent-up demand was fulfilled: The surge of buyer interest following the reopening of the economy rapidly consumed available listings in 2022, leading to a seller’s market. However, by late 2023, much of this demand had been met, causing inventory to rise again.

As a result, buyers were presented with more options, creating what is commonly referred to as a buyer’s market. This type of market allows buyers to negotiate lower prices, as sellers are more motivated to offload their properties in an environment with rising competition.

The rapid price decline during early 2024 reflects the broader dynamics of a real estate market adjusting to a sudden rise in inventory levels. As inventory levels in Manhattan grew, sellers had no choice but to respond with price reductions, setting the stage for the decline in the first few months of the year.

The Role of Inventory in the Manhattan Condo Market

Inventory levels are one of the most critical factors influencing Manhattan condo prices. In real estate, months of inventory refer to how long it would take to sell all available listings at the current sales pace. Inventory levels in a buyer’s market exceed 7 months, giving buyers more leverage and driving prices down. In early 2024, Manhattan condo inventory surged well beyond this threshold.

In 2021 and 2022, the Manhattan condo market experienced low inventory levels as pent-up demand absorbed listings faster than new ones appeared. However, in 2023, more sellers began listing their properties, and inventory levels rose steadily. By early 2024, this created a situation where supply outstripped demand, leading to downward pressure on prices.

The relationship between inventory levels and condo prices is straightforward:

- When inventory is low (below 5 months), sellers have the upper hand, and prices tend to rise.

- When inventory is balanced (5-6 months), the market doesn’t favor buyers or sellers, and prices stabilize.

- Buyers gain an advantage when inventory is high (7 months or more), and prices typically fall as seller competition increases.

By early 2024, Manhattan’s inventory had reached levels that created a buyer’s market, allowing buyers to negotiate lower prices. Many sellers, faced with longer listing times and more competition, began lowering their asking prices to close deals.

The impact of inventory on NYC real estate prices is clear: the higher the inventory, the more buyers can negotiate favorable terms. In 2024, Manhattan’s rising inventory levels caused sellers to adjust their expectations, contributing to the price declines seen earlier in the year.

Why Prices Recovered but Remain Below 2018 Levels

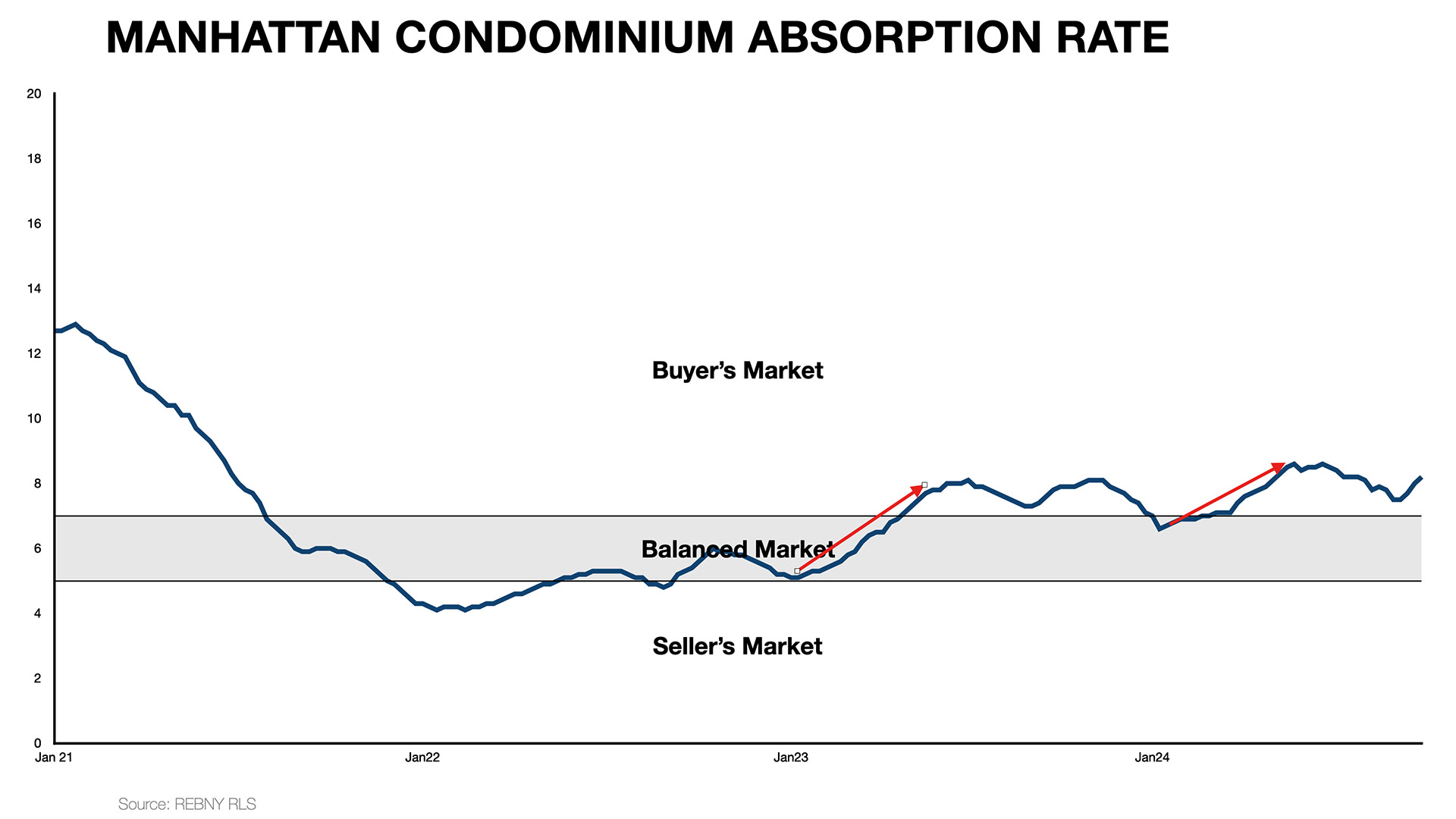

Although Manhattan condo prices started to rebound after their initial decline in early 2024, they are still lower than the levels seen in 2018. One of the main reasons for this is the decrease in inventory levels from their peak in the first quarter. Another significant factor is the shift in the tech sector, which plays a substantial role in New York City’s economy. After the pandemic, tech companies ramped up their hiring efforts. However, by 2023 and 2024, many of these companies began to downsize. Major players such as Google, Meta, and Microsoft have laid off tens of thousands of workers. This economic shift has led to a decrease in buyer confidence, particularly among high-income tech professionals.

However, despite this economic uncertainty, deal volume has increased in 2024. The average number of units going under contract is 89 per week, above the historical average of 82 per week. This shows that while buyers are active in the market, they take advantage of lower prices rather than push them up. In other words, demand exists, but the issue is the price buyers are willing to pay.

Many potential buyers are cautious about overpaying in a market where the supply of units is still relatively high, and economic factors, particularly in the tech sector, remain uncertain. As a result, while sales have risen, Manhattan condo prices have not returned to their 2018 peaks.

This combination of higher deal volume but lower prices highlights the market’s shift toward more buyer-driven negotiations, where purchasers are more selective and unwilling to match the price points seen in previous years.

What This Means for Buyers and Sellers in 2024

The real estate market in 2024 presents unique opportunities and challenges for both buyers and sellers. Manhattan condo prices are still below their 2018 levels, but deal volume is increasing, making the market interesting.

For Buyers:

2024 is shaping up to be an ideal year for buyers in Manhattan. High inventory levels and a market that favors buyers mean that there are more units to choose from, often at prices lower than in previous years. Even with the increase in units going under contract, buyers remain in a solid position to negotiate, especially as economic uncertainties, such as the tech sector downsizing, continue to influence decision-making.

Key benefits for buyers include:

More negotiating power: With sellers eager to close deals, buyers can negotiate on price, terms, and even concessions, such as paying for closing costs or including additional amenities.

Lower price points: While deal volume has increased, the issue is price, as buyers are being more cautious and selective, keeping prices lower compared to previous years.

A wide selection of units: The sustained inventory levels offer a broad range of condos across various price points and neighborhoods, giving buyers more flexibility in finding the right property.

For Sellers:

On the flip side, sellers are facing a more challenging environment in 2024. Even though units are being sold at a faster pace than the historical average, prices are still below 2018 levels, and buyers are not willing to pay premiums. To successfully sell in this market, sellers must be prepared to adjust their pricing strategies.

Critical challenges for sellers include:

Competitive pricing: With more inventory on the market, sellers need to price their units competitively to attract offers. Overpricing could lead to longer listing times and fewer interested buyers.

Flexible negotiations: Buyers have the upper hand in this market, so being open to negotiations and offering concessions can help close deals faster.

The impact of external factors: Economic factors, especially the softening of the tech sector, are creating cautious buyers. Sellers need to consider how these trends affect their target market and be realistic about pricing expectations.

In 2024, Manhattan’s real estate market will be defined by higher deal volume but lower price points. Buyers can take advantage of favorable conditions, while sellers must adapt to a more competitive and price-sensitive landscape.